By Yoruk Bahceli and Samuel Indyk

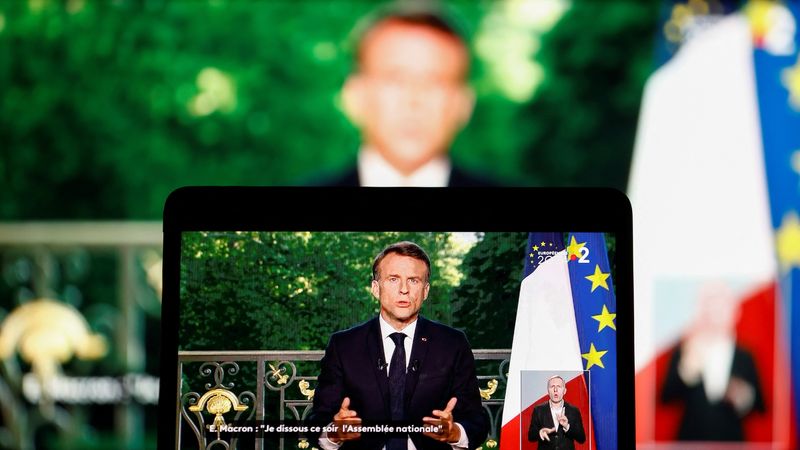

(Reuters) – The far right’s win in the European Parliament elections, which prompted French President Emmanuel Macron to declare a national shock, puts the spotlight back on the political risks in Europe that have long kept financial markets on edge. had put on the back burner.

The euro, French stocks and sovereign debt were all hit on Monday as investors assessed whether the far right can repeat their success in the French elections and how much influence far-right parties can have over the European Union’s new executive branch.

“Further economic integration will be slowed down rather than accelerated,” said Carsten Brzeski, global head of macro at ING, referring to the shift to the right in the EU.

Here are five key questions for markets:

1/ WHAT DO A SPICK FRENCH ELECTION MEAN FOR THE MARKETS?

French stocks are the clear losers from Macron’s surprise decision, which came after a heavy loss to Marine Le Pen’s far-right National Rally (RN) in the EU elections.

Leading lenders BNP Paribas (OTC:) and Societe Generale (OTC:) both fell as much as 8% on Monday.

Barclays’ head of European equity strategy Emmanuel Cau expected banks and utilities to bear the brunt of the uncertainty. Another concern was that populist parties could push for a bank tax, which could also cause unrest.

French government bonds could also suffer.

Major investors have already avoided them because of the high deficit: S&P has just downgraded France’s credit rating.

The risk is that a government will be less likely to comply with EU rules on controlling deficits, said Deutsche Bank, which also noted a strong performance for the Socialist Party.

The French-German interest rate gap was 7 basis points wider at 55 basis points on Monday, but remains well below the 80 basis points reached in 2017 when Le Pen, now less Eurosceptic, pledged to leave the euro.

“We expect some underperformance from French assets and by extension some underperformance from European assets as this contributes to a small European risk premium,” said Mark Dowding, Chief Investment Officer of BlueBay Asset Management.

He is underweight French government bonds and said the French spread could rise to more than 70 basis points if the RN gains.

2/ IS EUROPEAN INTEGRATION THREAT?

During the COVID-19 pandemic, the EU has taken unprecedented steps towards a fiscal union with an €800 billion recovery fund, with France a key player in making that possible. A shift to the right in that country and beyond could weaken the case for more.

The risk premium on bonds issued by Italy, a major beneficiary of the pandemic recovery programme, rose on Monday but remains well under control.

Longer term, the reduced prospects for programs similar to the recovery fund would imply a higher structural risk premium on the bonds of the bloc’s highly indebted countries, Citi analysts think.

3/ Will European climate policy suffer?

The Greens were one of the biggest losers in the EU elections.

The shift to the right is unlikely to undo existing climate policies, but it could make it harder to implement new ones and create loopholes to weaken laws that are in need of revision.

“On the margins, you might see some pressure on things like renewables within utilities and some relief for sectors like energy if you believe a more right-wing parliament would ease the green transition agenda,” said Barclays’ Cau.

4/ Will Europe become stricter on trade?

The EU’s executive branch, which is unlikely to change from its current centrist composition, imposes trade defense measures, not parliament.

But parliament’s shift to the right could have an impact.

The EU is already planning to impose tariffs on Chinese electric vehicles.

“The political shift to the right in the European Parliament and the outcome of new parliamentary elections in France will undoubtedly lead to more trade barriers between the EU and China,” said Joerg Kraemer, chief economist at Commerzbank (ETR:).

Any retaliation would hurt European auto stocks, up 4% this year versus an 8.5% rise in the broader market.

They recently took a hit over the prospects for higher Chinese tariffs. China could also target dairy products, wine and aircraft parts, Kraemer added.

5/ What about defense spending?

Since the Russian invasion of Ukraine, pressure on Europe to increase defense spending has increased.

Although Member States are primarily responsible for defense spending, almost two-thirds of respondents surveyed by Citi recently expect further joint EU funding for selective purposes such as defence. The bloc has also floated the idea of a new defense fund of 100 billion euros.

Any far-right resistance to further budget integration could dent these hopes.

There was also uncertainty about what the rise of the far right in Europe would ultimately mean for support for Ukraine, as markets grapple with a wave of geopolitical risks.