By Jeff Mason and Steve Holland

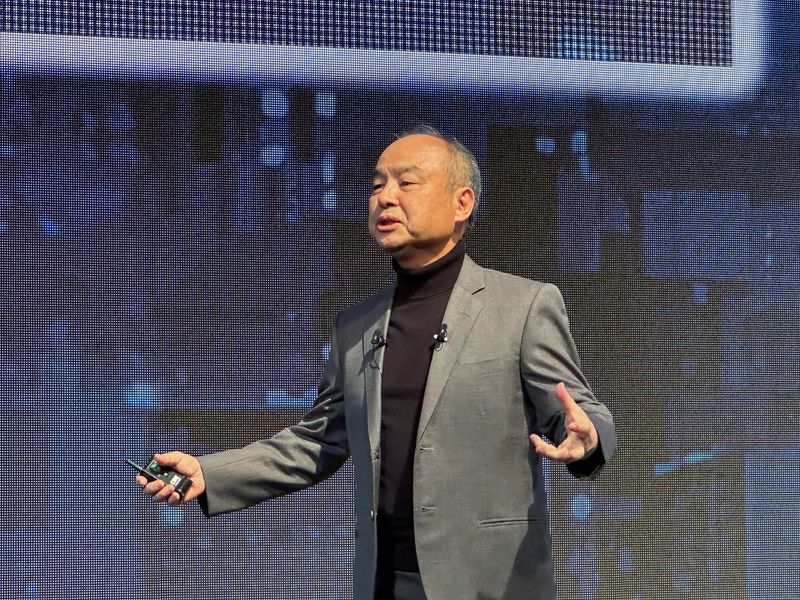

PALM BEACH, Florida (Reuters) – President-elect Donald Trump, with SoftBank (TYO:) Group CEO Masayoshi Son at his side, announced on Monday that SoftBank would invest $100 billion in the U.S. over the next four years in what would boost the American economy.

Trump said in his joint appearance with Son that the investment would create 100,000 jobs focused on artificial intelligence and related infrastructure, with the money deployed before the end of Trump’s term.

Monday’s announcement echoes a similar promise Son made in Trump Tower with then-President-elect Trump in December 2016, when Son said he would spend $50 billion and create 50,000 jobs.

While that money was eventually spent, it’s unclear whether those jobs were created.

Trump said SoftBank’s latest investment pledge is evidence of “monumental confidence in America’s future.” He playfully encouraged Son to make the $200 billion investment. Son chuckled and said he would try it.

The $100 billion pledge, made at a flag-decorated event at Trump’s Mar-a-Lago club in Palm Beach, Florida, is part of Trump’s pledge to strengthen the U.S. economy and reduce the impact of inflation on Americans. decrease during his second term. starts on January 20.

It is unclear how SoftBank plans to finance the investment promise. SoftBank Group had about $27 billion in cash on its balance sheet as of September 30, according to its most recent earnings report. The company’s Vision Fund 2 also has $3 billion to deploy. The capital could also come from the chip maker Arm Holdings (NASDAQ:), according to a source familiar with the matter.

Trump called Son “one of the most accomplished business leaders of our time.”

SoftBank is rebuilding its finances after the failure of a successful office-sharing startup We work (OTC:) and after some of the tech companies it invested in through its Vision Fund unit fell out of favor among investors. Shares of SoftBank rose more than 3% in trading in Tokyo on Tuesday morning after the announcement.

Trump has an affinity for splashy announcements that promise thousands of jobs, even if such investments don’t always materialize. At the beginning of his first term, he announced a $10 billion investment Foxconn (SS:) in a Wisconsin factory that promised thousands of jobs but was largely abandoned.

“I don’t think there’s a tangible plan on the horizon,” Amir Anvarzadeh, Japan equity strategist at Assymetric Advisors, said of SoftBank’s announcement.

“The question becomes, what are they going to buy? There’s already a lot of money chasing great companies. The low-hanging fruit in AI has come and gone,” Anvarzadeh added.

Son is a big believer in the potential for AI and has pushed to expand SoftBank’s exposure to the sector, taking a stake in OpenAI and acquiring chip startup Graphcore. After a sharp decline in shares between 2021 and 2023, SoftBank shares have recovered, with a gain of almost 55% this year.

In October, Son reiterated his belief in the arrival of artificial superintelligence, saying it would require hundreds of billions of dollars in investments.

Son said at the time that he was saving money “so I can take the next big step,” but gave no details.

“We do not expect the company’s AI investment plans to have materially changed,” Astris Advisory analyst Kirk Boodry wrote in a note. “The company is making a commitment that is largely based on existing commitments.”

Trump promised last week that he would expand accelerated licensing to any company investing $1 billion or more in the United States.