By Joanna Plucinska and Allison Lampert

FARNBOROUGH, England (Reuters) – A drop in Ryanair’s quarterly profits cast a shadow over the opening of the Farnborough Airshow on Monday, where airline leaders were already worried about supply chain problems, plane delays and floundering plans to cut emissions.

Boeing (NYSE:) announced a major order from Korean Air for 20 777X jets and 20 787s, worth $7 billion according to Cirium Ascend’s estimated delivery prices, boosting the US planemaker’s long-delayed 777X program.

But many delegates at the July 22-26 meeting of aviation leaders did not expect the traditional flurry of deals, as Airbus struggles to meet production targets and Boeing takes a calm stance amid the safety crisis sparked by a panel that flew from an airplane. 737 MAX jet in January.

Aviation was hit hard by the pandemic, with air travel collapsing and then recovering sharply. That left many companies struggling to address labor and parts shortages.

The situation has been exacerbated by a spiraling crisis at Boeing, which has had to slow production of its best-selling 737 MAX plane after the panel blowout.

Delays in aircraft deliveries have hampered airlines’ efforts to capitalize on the post-pandemic rise in travel costs and inflated costs, and there are increasing signs that they are struggling to pass those costs on to consumers as the demand is starting to normalize.

Ryanair, Europe’s largest budget airline, reported a near halving of quarterly profit on Monday, with fares falling 15% and management warning of more pressure to boost prices.

CEO Michael O’Leary added that there had been some improvement in Boeing’s deliveries, but there were still delays and he was becoming a little concerned about deliveries coming next year.

In addition, Flydubai said its fleet expansion plans had been hit by Boeing delivery delays, while Air India’s boss said it had to strip parts from some of its other planes to keep planes flying amid the airline’s supply chain woes industry.

“The big question for the airlines here in Farnborough is what happened to the halo effect of demand after the pandemic – has that recovery stalled?” said veteran aviation journalist Mark Pilling, who would host a panel of CEOs.

Pegasus Airlines CEO Guliz Ozturk told reporters that customers were going “back to basics” in search of lower fares.

“We have started to see the normalization of demand. What does this mean? I mean, the demand is there, but now, like before the pandemic, travelers are looking for the most affordable, the lowest, the best price for their trips.”

Immediately after Ryanair’s warning, Air Canada cut its full-year core profit forecast, blaming overcapacity in some markets and weaker pricing power on international routes.

The stock fell nearly 4% in early trading. Airline shares were among the biggest fallers in Europe, with Ryanair down 16% at 4pm GMT, easyJet (LON:) down 7.5%, TUI down 4.6% and BA owner IAG down 3.5%.

However, Boeing vice president of commercial marketing Darren Hulst said there was no sign of a weakening in aircraft demand and suggested the airlines’ warnings were just a sign of “a little bit more reality in the market.”

CONFIRMATION OF SUPPLY CHAINS

With dealmaking expected to be limited, the focus at the air show will likely be on how manufacturers are tackling supply chain blockages.

Asked about flydubai’s complaints, Hulst admitted that Boeing had “disappointed our customers time and time again, in many cases” but that the work the company did this year was aimed at ensuring this would not happen again .

Airbus CEO Guillaume Faury also said on Sunday that the European plane maker is making progress in ramping up production of its top passenger jets.

Some deals will fall through the cracks, representatives said.

Japan Airlines said it had ordered 10 Boeing 787-9s and agreed options for 10 more, while Vietnamese budget carrier VietJet struck a deal for 20 Airbus A330neos.

Industry sources said Virgin Atlantic was about to place an additional order for Airbus A330neos and Saudi low-cost carrier Flynas was about to order 30 of the same widebody aircraft. The companies declined to comment.

However, Turkish Airlines said the engine talks still stand in the way of a potential major order from Boeing.

This week’s air show will be peppered with sustainability panels and workshops, as aerospace giants and airlines look to emphasize their commitment to cutting carbon emissions even as they plan to massively expand global air travel.

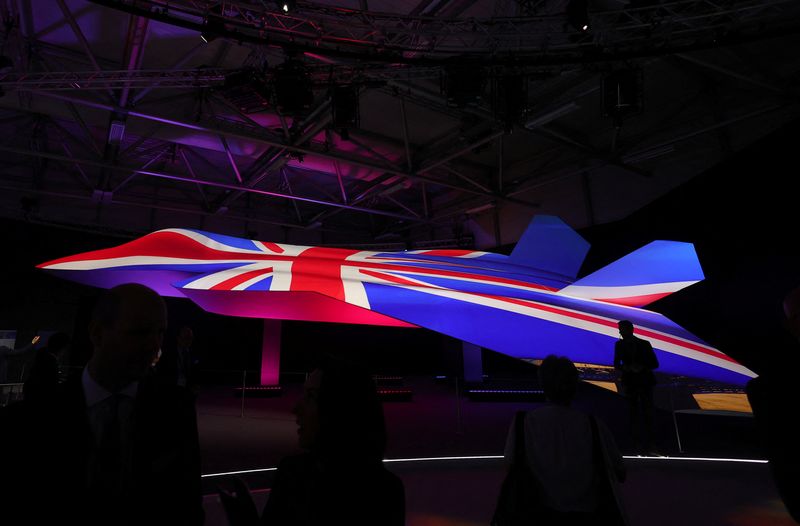

On the defense side, the focus will be on Ukraine, possible delays in the future replacement of the US F-22 fighter jets, codenamed NGAD, and a defense review by the new British Labor government.

During the show, British Prime Minister Keir Starmer stressed the importance of Britain’s fighter capabilities, but could not guarantee that the next-generation combat air program with Japan and Italy would not be affected by the review.