The way that money works is changing.

Once upon a time, you could put all your extra money into savings accounts and retirement funds, and feel confident in your financial future.

Today, financially literate people understand that savings and traditional retirement funds won’t provide the kind of stability and security needed in another 40-50 years.

Investing your money in ways that allow it to grow and provide a passive income over time is critical to your financial future, but where do you begin?

There’s a lot of confusion surrounding investing — partly because the term is often misused and partly because it feels like you need an entire degree to understand the options.

Fortunately, investing isn’t as confusing as it might sound.

In this article, we lay out:

You’ll find out how to invest to save for retirement and get answers on how to generate passive income immediately.

If you’ve ever wondered what investing is or how it all works, this article will answer your most pressing questions and help you understand which types of investing will help you best meet your financial goals.

What Is Investing

Related to finance, investing is using your money to purchase something that offers the potential of profitable returns such as income, interest, or appreciation.

Simply put, investing is when you use your money to earn more money.

For example, if you’re 18 years old and you do something as simple as skip your daily Starbucks run or pack a lunch instead of eating out, you could turn those $10 daily savings into a million dollars over the course of your lifetime.

Investing is about sacrificing a little bit today to build yourself a financially stable future. You don’t need to invest a ton of money or spend a lot of time to do it.

You only need to take a little bit of time to understand how investing, risk, and compound interest work, and then you can start investing (you can even set it to autopay to make it easier!).

Active Versus Passive Investing

Spending your money to get an education or start a business is considered a “good investment.”

Active investments, such as education and entrepreneurial activities, require your time and presence to flourish.

Since there is only one of you, you are limited in the amount of money you can earn from active investments.

While education and business (and other types of active investing) are definitely a good investment in your future, they are not strictly investments, since you also work for the profits.

When people talk about investments related to finance, they’re referring to passive investments.

Passive investments, such as the stock market and real estate, allow you to earn money without having to work for it, and you don’t need to take time away from your regular job or business to make a profit.

With passive investing, your money does the hard work for you.

For example, when you put your money into a retirement account, it will likely earn interest over time. That’s money that you earn without having to work for it — technically, a “passive investment.”

With passive investments, your money builds upon itself every minute of every day, so long as it stays in that account. It’s slow, but you can see huge returns if you invest for long periods of time.

Why Savings Accounts Are A Terrible Investment

You’ve probably heard your grandparents or parents talk about the importance of saving money in the past. But the economy – and money – has changed dramatically over the past seventy years.

Today, if you put $10,000 in a typical savings account and leave it there for a year, you’ll make about one dollar.

A savings account that pays half of one percent interest (the average for a U.S. savings account) can’t keep up with the current inflation rate of 5%, so you are guaranteed to lose if you save money.

So if you previously thought you’d store your money in a bank to build security for your future, you need to rethink your approach because the money in your savings will lose a significant amount of value over your lifetime.

You could literally go broke from saving your money in a bank for many years.

That’s why, in this new economy, financial literacy is critical to securing your future so that you can enjoy financial stability throughout your lifetime.

Understanding how to put your money into investments that return a high rate of interest or profits, such as the stock market or real estate, is an essential aspect of learning financial literacy.

And just in case you’re thinking that investing is something for “old people,” we strongly recommend that you begin investing by the time you turn eighteen.

Investing from a young age means that you won’t have to make huge sacrifices to build wealth for your future.

When you begin investing at a young age, you spend less, earn more, and are more likely to manage your finances responsibly as you grow.

Why Investing Matters

When your grandparents were young, finances were simpler.

If you got a decent job, you could stay at it for fifty years and retire comfortably with a healthy pension.

Times have changed since then. A lot.

Putting your emergency savings in the bank IS a good move. You want to bank the equivalent of six months of living expenses, in case you have a life emergency such as a job loss, medical expenses, or… a pandemic.

A bank is the best place to store your emergency savings because it’s safe and you can access your money whenever you need it.

However, the rest of your “savings” is better off in an account where its value will increase over time.

If you invest wisely over your lifetime, your money will retain its value AND return a nice profit that will help you enjoy some of the things that motivate you to work in the first place: vacations, luxury items, and the ability to help others.

That’s why investing matters.

No matter how much you love your job, there will be times when you’d rather do something other than go to work. Perhaps an old friend is in town visiting, or you’re newly married, or you’re just not feeling great and would rather stay home and Netflix your way through the day.

On those days, if you’re a hustler, you go to work anyway because you know that the sacrifice is worth the rewards.

Investing makes your sacrifices more worthwhile.

Investing can take a $10 daily deposit and turn it into millions of dollars by the time you’re 65 years old because it puts your money to work for you while you’re off doing other things such as working and spending time with family and friends.

Investing matters because if you don’t invest, your hard-earned money won’t be worth much in forty or fifty years. If you put your money in savings, you could go broke, but if you put it into smart investments, then your hard work can pay off financially.

Is Investing Risky?

All investments carry some type of risk.

Even the safest investments, such as a savings account or stocks and bonds, can lose their value due to inflation.

Typically, the more risk you take, the more money you can earn — or lose.

When you’re wanting to build financial security for your future, take the following five steps to lower your risk.

5 Steps To Lower The Risks Of Investing:

- Put your money into medium-to-low risk investments that provide a decent return.

- Diversify your investments. In other words, don’t “put all your eggs in one basket.” For example, when you put all your investment money into one company, your risk of losing increases dramatically.

- Research the platforms, apps, and people who assist you in investing.

- Network with other investors.

- Continue to learn more about investing over time.

Understanding how investing works, and researching before you buy, is essential to building profits and security over time.

When Should You Begin Investing?

Begin investing by the time you turn eighteen, if possible.

You can learn as you go.

You don’t need to become an investment genius to get started in the most popular investment strategies such as the stock market. What matters is that you learn as you go.

Connecting with other investors through online forums, Reddits, or other social media can provide you with an excellent way to accelerate your experience and learning process.

Watching your investments grow, and learning from your small mistakes, will help you make wiser decisions in the future.

If you start investing in the stock market when you’re eighteen years old, your money will earn 80% more than if you wait until your early forties!

In fact, if you only invest $10 a day from the ages of 18 – 40 (and stop investing at age 40) and earn a less-than-average return of 7%, you’ll retire a millionaire.

Investing At 18 Years Old Or Earlier

Imagine you faithfully invest $300 a month ($10 a day) until you’re forty years old.

This leaves you with plenty of money, as you grow into your career, to purchase a home, enjoy family vacations, and put your kids in good schools, as long as you earn a decent living and manage your money wisely.

By the age of forty, you’ll have invested about $80,000. Even if your investments return a little less than average (7% instead of 8 – 10%), if you let it sit and keep reinvesting the earnings from it, you retire a millionaire.

On this plan, you stop investing at age forty and enjoy a bigger home and fancy cars and vacations — or whatever it is you dream of enjoying in life.

While you’re out enjoying life, your money is working for you, until it eventually grows to $1,000,000 by the time you’re 65.

Investing at 40 Years Old Or Later

If you wait until you’re in your forties to invest $10 a day, your money only makes a fraction of the profits.

Even though forty is roughly halfway to retirement, your investments don’t make half the earnings.

Investing about $300 a month beginning at the age of forty, you’ll put in about $90,000 by the time you reach 65 years old, but that money only grows to $246,198 — not enough to retire comfortably.

$10 a day can turn you into a millionaire if you invest during the early years of your life, but if you wait until your forties, it earns less than one-quarter of a million.

If you’re already older, though, all hope is not lost.

If you begin investing $600 per month at the age of forty, continue investing until you’re 65, and earn a 10% return, you can retire with close to a million dollars ($850,000).

Or, if you invest $900 per month from ages 40 – 65 and manage to get a 10% return, you can earn $1.25 million dollars by the time you’re 65.

When it comes to investing, sooner is always better.

What Are Passive Investments?

Passive investments allow your money to grow and earn more money while you’re doing other things, such as sleeping, running a business, or traveling the world.

Passive investing requires little to no time on your part, but it’s essential that you set time aside to learn about investing when you’re first getting started.

Understanding investments before you spend money on them provides several benefits:

- Helps you avoid scams

- Helps you avoid unnecessary fees and charges

- Helps you invest your money more wisely

- Helps you build a strategy so you can avoid emotional buying and selling

The most popular passive investments are stocks and real estate, although more adventurous investors might expand their interests to include commodities, bonds, and cryptocurrencies.

Getting an education or starting your own business are good investments, but they are not passive investments because both require your time and hard work.

A home is not an investment.

The home you live in is not an investment. Investments grow in value, but a home depreciates. You may put time and money into the house to hold or increase its value, but that’s work and creativity — not an investment.

In the sections below, we show you how the most popular passive investments work, and how you can get started investing in them on almost any budget.

What Is Stock Market Investing?

Stock market investing is a popular way for people to build wealth and prepare for retirement without having to invest a lot of time.

A stock is a share of a publicly traded company that can be bought and sold. When you purchase a stock, it makes you a shareholder of the company.

When you purchase shares of a company, you become part-owner of it. Instead of spending money at the McDonald’s drive-through, you can turn your cash into shares and own part of it!

- When McDonald’s does well, more people buy its stocks and your shares increase in value. Congrats! You’ve increased your wealth through stock market investing!

- However, if McDonald’s does poorly, your shares drop in value and your stocks are worth less money.

As a shareholder, you own a piece of the company and get to enjoy some of its profits.

Selling stocks at a higher value than what you paid for them is one way to earn money in the stock market, however, many companies also pay quarterly dividends to shareholders when the business is doing well.

Owning shares in a company doesn’t give you the right to tell people what to do or weigh in on decision-making.

As a shareholder, your stake in the company is exclusively financial.

After all, your shares only make you one of many investors who own a piece of the company.

For example, a typical startup company might have ten million shares (even more as it grows) that are sold to investors.

What Is The Stock Market Versus The Stock Exchange

The “stock market” is a broad term that refers to the markets in which stocks (shares of publicly-held companies) and other equities are bought, sold, and exchanged.

The stock exchange is a physical marketplace, online and offline, where equities (stocks, bonds, etc.) are sold.

There are sixteen registered stock exchanges in the United States.

- The New York Stock Exchange (NYSE) is the largest stock exchange in the world.NYSE is a 16,000-foot trading floor located in the financial district of lower Manhattan with an equity market capitalization of more than $25.3 trillion.

- TheNasdaq Stock Market (NASDAQ) is the second-largest stock exchange in the world. NASDAQ was the first electronic exchange, all its stock trades happen online.

Together, the NYSE and Nasdaq are worth $32 trillion of the global $105 trillion equities market.

Other U.S. stock exchanges include:

- AMEX

- BATS Global markets

- Over-The-Counter (OTC) and Pink Sheets

- OTC Markets (formerly Pink Sheets)

- OTC Bulletin Boards (OTCBB)

Other major stock exchanges outside the U.S. include:

- Toronto Stock Exchange (TSX)

- London Stock Exchange (LSE)

- Tokyo Stock Exchange (TSE)

- Australian Securities Exchange (ASX)

- BM&F Bovespa (BM&FBOVESPA)

The term “stock market” is a broad term that refers to all the people and companies involved in exchanges on the stock market, while “stock exchange” is the physical (online or offline) location where exchanges happen.

What Is A Brokerage Firm?

You can’t just run out and purchase stocks at your neighborhood convenience store.

To buy and sell stocks, you must go through a licensed professional called a “stockbroker.”

All stock market transactions happen through a stockbroker.

A stock brokerage firm is a financial company that buys and sells financial assets on behalf of clients.

Most stock brokerage firms charge some form of commission or fee to use their service.

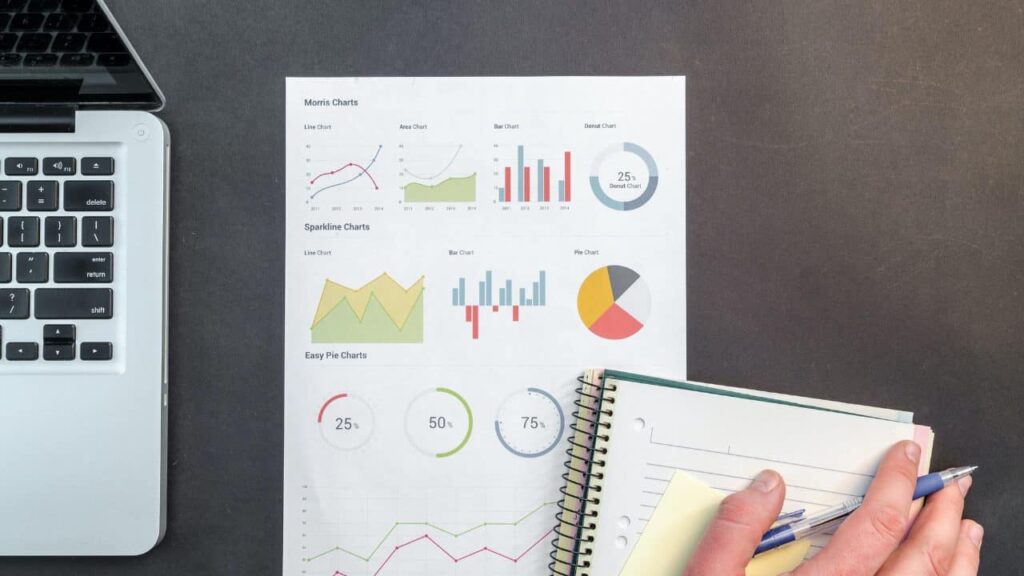

Many, such as Webull and Charles Schwab, are geared toward beginners and charge low or no fees while also providing plenty of educational resources, visual tools, and portfolio pie charts.

Low fees, minimum deposit requirements, and educational resources allow beginners to start investing in the stock market without a lot of money or experience, which is an excellent opportunity for many people.

How Do Shareholders Make Money?

Shareholders make money through appreciation and dividends. Passive investors build wealth by reinvesting the money they make from the market, which is called “compound investing.”

What Is Appreciation?

Appreciation is when stocks rise in value and can be sold for a profit.

For example, if you purchased a thousand stocks at $100 each, and over time they went up in value to $200 each, you could sell them for $200,000 and earn a profit of $100,000.

You can take your $100,000 profits, cash them out, and do as you please with the money. Or, you could reinvest your earnings and try to turn them into even bigger profits.

What Are Dividends?

When a publicly-held company is doing well, they often share the profits, called “dividends,” with their shareholders, usually each quarter.

Not all stocks pay dividends, but many of them do.

Many stock brokerage sites allow users to filter stocks by which ones pay dividends, so investors can shop for dividend stocks (if they prefer) when investing.

Dividends may be paid in cash or investors may receive more shares to increase their investment.

Before you begin planning how to spend your dividend earnings, though, you should know that people become millionaires by reinvesting their dividends, not spending them!

Reinvesting dividends in the stock market is referred to as “compound investing.”

What Is Compound Investing?

Compound investing, related to the stock market, means that you continually reinvest your dividends.

Instead of spending or banking your dividend payments, you use them to purchase more stocks in the company.

For example, Starbucks shareholders receive an average of 41 cents per share, per quarter, in dividends. So, if you own 1,000 shares of the company, compound investing means that you would use your $410 dividend check to purchase additional Starbucks stock.

Next quarter, you earn dividends on your original shares plus the shares you bought with the previous quarter’s dividend earnings. The following quarter, you do the same.

This way, your dividend checks become larger each quarter since you own more stocks than the previous quarter.

Compounding, or reinvesting your dividends over time, is one way that people become millionaires through stock investments.

The more shares you own, the higher your dividends = the more shares you can buy. The more shares you buy, the more money you earn through dividends.

Over time, this continual reinvesting has a snowball effect that dramatically increases your stock portfolio.

Over the course of 30 or 40 years, compounding really adds up.

Keep in mind, though, that all investing involves risk.

Compounding your investments (rather than spending your dividend checks or selling when stock values rise) isn’t for people who allow emotions to influence their investment decisions.

It’s not easy to hold onto stocks when the market begins rising or falling. The temptation is to sell and cash out on your profits when values rise or to sell and minimize your losses when stock values drop.

However, history shows that stock prices will always rise and fall, and investors who hold on during economically shaky times usually end up profiting.

If you’re serious about passive investing for long-term wealth, you’ll want to develop a strategy that involves reinvesting your dividends rather than cashing them out.

Reinvesting compounds your earnings and builds wealth over time.

Note: Stock “trading” is a different approach that involves more time and knowledge than passive stock investing. Trading is not a passive investment. If your goal is to invest and build wealth over time with minimal risk, avoid stock trading and focus on buy-and-hold stock investment strategies.

Types Of Stock Investments

There are several types of stock investment products to choose from, including stocks, bonds, mutual funds, and index funds.

For passive investors looking to keep their risk low and use a buy-and-hold strategy, we recommend index funds, ETFs, or mutual funds.

Index funds are passive investments that follow a specific index (group of equities) such as the S & P 500. Index funds are one of the easiest ways to get started investing because you don’t have to spend time researching individual companies.

Mutual funds are a collection of investments paid for with money from multiple investors and managed by a professional.

Options are high-risk investments that involve an agreement that you will buy and sell stock by a specific date.

Bonds are loans you grant to a company or the government. They are paid back to you, with a set interest rate, so you know in advance how much you’ll earn. Bonds are long-term investments that pay a fixed annual rate.

Commodities are physical, tradable goods listed on the stock market, such as metals, gold, coffee, oil, gas, and others. The value of commodities relies on supply and demand, which creates a sometimes-volatile market.

Given the massive amount of activity involved in stock market investing (from research to decision-making to making trades) you might wonder how it can be called a “passive” activity.

Researching all those companies and investment types, while also tracking their performances, could easily turn into a full-time job.

That’s why index investing, ETFs, and mutual funds are popular way for people to approach the stock market.

What Is Index Investing?

Index investing is a passive form of stock investing that requires little to no research on your part.

Instead of buying individual stocks, you purchase a collection of stocks chosen by experts that closely follow their performances.

A stock market index (such as the S & P 500, Dow Jones, or Nasdaq) is a method of tracking and reporting on a specific group of stocks.

Each index tracks a different group of stocks.

Indexes make stock investing easier and quicker because they allow you to evaluate the performance of a group of companies rather than attempt to individually track the activity of dozens or even hundreds of separate ones.

For example, the Dow Jones index tracks the performance of 30 companies, whereas the S & P 500 index tracks the performance of 500 companies.

Why Indexes Are So Popular With Passive Investors

If you want to balance out your investments in a way that lowers your risk (like most long-term investors do), you’ll purchase stocks from many different companies instead of gambling on the success of only one or two.

You can imagine how, as you invest over the years, it might become time-consuming to review the performance of hundreds of companies whenever you want to know how your investments are doing.

It could also be energy-consuming and potentially damaging to your portfolio to choose all of your stocks in the first place.

Even if you dedicate your time and effort to research, your understanding still won’t equal the knowledge of experts.

Indexes are popular with investors because they let you invest in and track the performance of a group of investments that have been chosen by experts instead of sifting through hundreds or thousands of options and reports.

What Are The Top Stock Indexes?

There are about 5,000 stock indexes, but the Dow Jones industrial average, Standard & Poor’s 500, and Nasdaq Composite are the most popular.

- Dow Jones Industrial Average (DJIA)The DJIA index was developed in 1896 to track the biggest corporate names in America. It now tracks 30 blue-chip stocks, including Microsoft, Disney, and Johnson & Johnson.

- Standard & Poor 500 (S&P 500)The S&P index, launched in 1957, reports on the top 500 publicly-traded large American companies from all genres of the economy, including Chipotle Mexican Grill, Tesla Inc, and NVIDIA Corporation.

- Nasdaq Composite (NASDAQ)The Nasdaq Composite index, created in 1971, tracks almost all of the companies (over 3,000) that are listed on the Nasdaq Stock Exchange, including Apple, Facebook, and Amazon.

There is crossover in indexes. For example, Apple is listed in several indexes, including Nasdaq and Dow Jones Industrial.

When you invest in an index fund, you’re investing in a specific group, or “basket” of securities that track a broader market.

Indexes are a low cost, low risk way to pursue average market returns.

What Are ETFs And Mutual Funds?

Mutual funds and ETFs are a variation on index funds that provide additional ways to diversify your equities as a passive investor.

ETFs and mutual funds are SEC-registered investment companies that are:

- Managed by finance professionals

- Comprised of stocks, bonds, and other assets

There are a handful of differences between index funds, mutual funds, and ETFs, mainly related to:

- Fee structure

- How equities are bought and sold

- When equities are bought and sold

Mutual Funds

Mutual funds are actively managed funds, a changing collection of securities determined by the fund manager.

This means that a professional money manager works on your behalf to try and beat the market by purchasing stocks they believe will rise in value and selling stocks they think will not do well.

If you were to invest in multiple companies on your own, you would have to decide how much of each company to buy into, and when to buy or sell for the best profits.

With a mutual fund, you have an expert working for you who decides what to buy and sell, and when to do it, at their discretion.

This allows you to diversify your investments and pursue higher returns than the average index fund, but it also comes with higher fees and more risk.

- Fees: Mutual fund fees run about 2% per year.

Two percent is a significant amount of money over time, especially as your investments grow and compound.

For example, if you invest $500 a month for 30 years, and your mutual fund investments get a typical 7% return, you pay more than $158,799 in fees alone.

Source: Dinkytown

- Risk: Mutual funds are a higher risk than index funds, yet often end up returning less over time.

The idea behind paying higher fees and taking more risk with mutual funds is to reap higher rewards from your investment. To do that, your money manager needs to outperform the stock market average.

Unfortunately, many mutual funds don’t earn as much as simple index funds, whose fees and risk are lower.

Index Fund Investing

Index fund investing was created in 1975 as a way for regular people to compete with pros in the stock market.

- Fees: Index fund fees are significantly lower than the cost of mutual funds, since their trading activity is determined by a computer algorithm instead of a money manager.

For example, Vanguard Total Stock (one of the largest index funds) charges only 0.04% per year. That’s only four cents per hundred dollars of investment compared to the average mutual fund fees of two dollars per hundred invested.Tip: shop around when investing in index funds because some charge more than 1% in annual fees – an outrageous makeup compared to the 0.04% mentioned above.

- Risk: Index funds provide a low-risk way to invest for typically average returns.

While index funds aren’t profitable every year, the S&P 500, for example, has returned a historic 10% annually since 2019.

Jack Bogle, former President/CEO of the Vanguard Group, created index fund investing in 1975, but was passionately disappointed to see them develop into ETFs over time.

Bogle felt that ETFs encouraged rapid trading by financial institutions rather than long-term passive investing by regular people.

ETF Investing

Exchange Traded Funds (ETFs)are Index Funds that are bought and sold in a different way.

The main differences between index funds and ETFs are:

- Index funds can only be bought and sold at the close of the day, but ETFs can be bought and sold anytime.

- Index funds typically require a $3,000 minimum investment, but ETFs have little or no minimum investment requirement.

- ETFs provide better tax benefits than index funds. When you sell ETFs, you pay capital gains tax only for that sale. With index funds, net gains are passed along to all of its investors, so you could end up owing capital gains taxes even if you don’t sell any of your funds.

Fees and risks are about the same with ETFs and index funds — both are low cost and low risk.

Always shop around to find the lowest fees, because some ETFs charge higher fees for the same investment product.

Pros And Cons Of Mutual Fund, Index Funds, and ETFs

Pros And Cons Of Mutual Funds:

PROS:

- Hands-off passive investment

- Diversified portfolio

- Professional works on your behalf to earn higher-than-average returns

CONS:

- Higher fees

- More risk

- Often earns less than low-fee, low-risk index and ETF investing

Pros And Cons Of Index Funds:

PROS:

- Hands-off passive investment

- Diversified portfolio

- Super low fees

- Low risk

- Have provided 10% returns since 2019

CONS:

- Costlier tax structure than ETFs

- Can only buy and sell at close of trading day

- Minimum investment requirements

Pros And Cons Of ETFs:

PROS:

- Hands-off passive investment

- Diversified portfolio

- Super low fees

- Low risk

- May provide excellent returns

- Better tax structure than index funds

- Can buy and sell at anytime throughout the day

- No minimum investment requirements

CONS:

- All investments carry some risk. Be sure to do your research and shop around before investing.

- Mutual funds are a changing list of securities, determined by an investment manager who works to outperform the market so your shares earn more money. While mutual funds are less predictable than indexes, they also attempt to provide higher rewards.

Should You Invest In Index Funds, ETF’s, Or Mutual Funds?

Long-term investors are probably looking for diversified, passive investments with low risk and a high chance of building wealth over time with a compound investing strategy.

Index funds, ETFs, and mutual funds meet all of those qualifications — so which should you choose?

Or, should you choose the companies yourself and invest individually?

Warren Buffett advises most people to invest in S&P 500 over individual stocks.

According to Buffet, choosing individual companies is very high-risk and not as easy as it sounds. For example, in 1903, more than 2,000 car companies failed even though they were on the edge of changing the future.

He likens free stock trading, where people buy and sell individual company shares, to gambling.

Buffet feels so strongly about index funds that, in 2007, he made a million-dollar bet with Protege Partners that their hedge funds couldn’t outperform the S&P 500.

He won the bet.

Buffet’s index fund investment returned 7.1% compared to his rival’s hedge fund returns of 2.2%.

If you’re looking for a passive investment strategy with average returns, low fees, and low risk, then index funds or ETFs are probably the best option for you.

ETFs provide the same benefits and investment as index funds, but they typically have no minimum investment requirement and also provide a tax structure that’s less costly for most people.

For these reasons, ETFs may be the best choice for long-term, passive investors.

Before you invest, do your research. In some cases, mutual funds may be a better option than index funds.

In all cases, investing is a risk.

All investing — whether it’s real estate, stocks, or any other type — poses some amount of risk.

The challenge, with any type of investing, is to balance the potential risks and rewards in a way that works best for you.

How Much Money Can You Make From Stock Investing?

How much money you make from stock investments depends on several factors, including:

- How much money you put into investments

- How long you continue investing

- How long you allow your investment to continue growing

- Whether you reinvest your dividends

If you faithfully put your money into good investments each month, continually reinvest their earnings, and allow them to grow over decades, you can make a lot of money from the stock market.

For example, we mentioned above that if you invest $300 a month into stocks from the ages of 18 – 40, and get a below-average return of 7%, you’ll have one million dollars when you turn 65.

If you’re willing to take it a step further, your money can multiply even more.

For example, if you take time to learn more about the stock market so you can make better investments, you might be able to get a 10% return instead of 7%.

If you invest the same amount of money ($300 per month) for the same amount of time (ages 18 – 40), but earn a 10% return instead of 7%, you’ll have 3 million dollars by the time you turn 65.

If you invest $600 a month instead of $300, from ages 18 – 40, and earn a 10% return, you’ll have 5 million dollars by the time you’re 65.

If you invest $600 a month from the ages of 18 – 65 (instead of stopping at age 40), and earn a 10% return, you’ll have 6 million dollars by the time you’re 65.

Investments rely on time and patience to grow. The more money you put into them and the longer you let them sit, the more your money will grow.