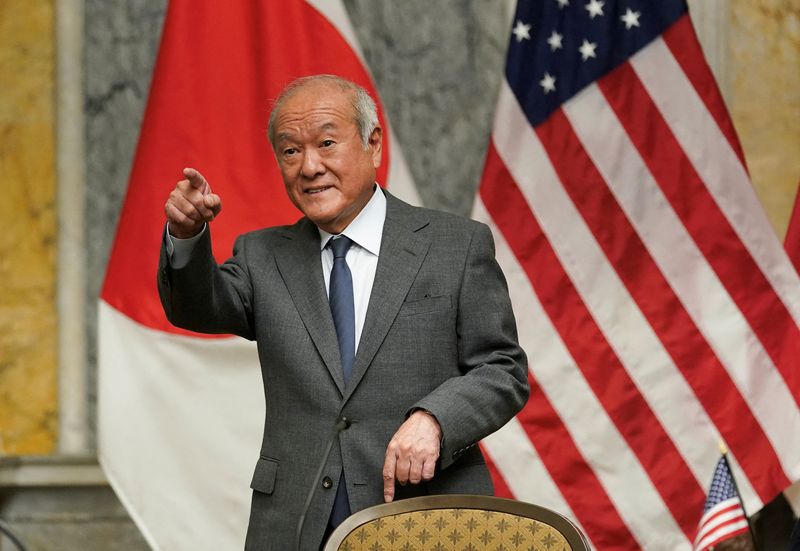

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki said on Friday that foreign exchange intervention should be done in a cautious manner, after data suggested Tokyo was tapping a huge amount of foreign reserves for its recent yen buying operations.

“Foreign exchange interventions should take into account their necessity and effectiveness,” Suzuki said at a press conference after the cabinet meeting.

While intervention can be used to curb excessive movements in the foreign exchange market, such action “must be carried out in a restrained manner,” Suzuki said.

Finance ministry data showed on Friday that Japan’s foreign reserves fell to $1.23 trillion at the end of May, down $47.4 billion from a month earlier, largely due to a decline in foreign securities holdings.

Japanese authorities will not reveal the composition of the country’s foreign reserves, but it is believed that the majority of foreign securities are held in US government bonds.

“It is almost certain that Japan has sold some of its US government bonds to finance the sale of dollars and the purchase of yen,” said Ueno Tsuyoshi, senior economist at the NLI Research Institute.

Finance Ministry data showed last week that authorities spent 9.79 trillion yen ($62.85 billion) on market interventions to support the yen. It is generally assumed that this took place in late April and early May.

($1 = 155.7800 yen)