Investing.com — In a recent interview, Investing.com spoke with Luciano Duque, the Chief Investment Officer of C3 Bullion, and Christopher Werner, the Chairman and CEO of C3 Bullion, to understand how they are turning the perception of a static asset into an income-generating investment.

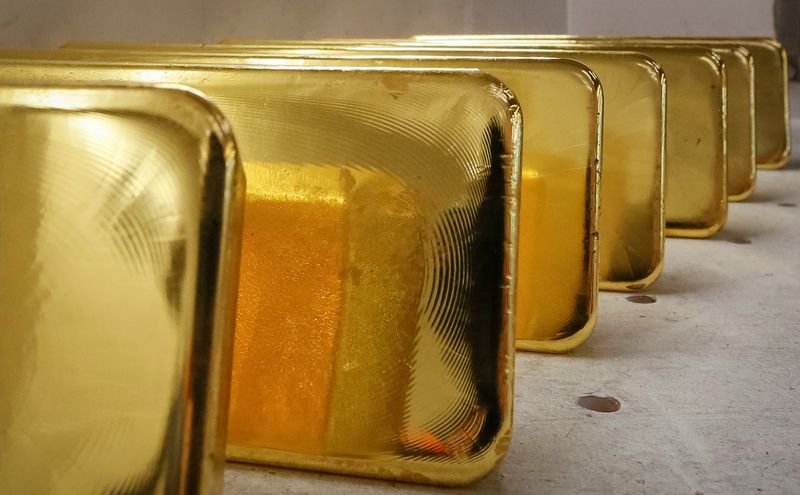

Traditionally, gold is considered a safe but passive asset. However, C3 Funds has developed a unique approach that allows investors to earn income from gold without relying solely on price appreciation.

Luciano Duque, drawing on his background in asset management, explained that typical portfolios contain a small allocation to gold, which is usually stagnant and not generating income.

Unlike stocks or bonds, which can earn dividends or interest, gold simply exists and only produces returns when its market price rises.

C3 Funds’ strategy includes direct investments in gold mining activities. By providing capital to these mines, the company secures a unique position, allowing it to purchase gold at a discount to the market price. This benefit translates into returns for investors.

Instead of owning shares of a mining company, which carries risk, or investing in traditional gold ETFs like GLD (NYSE:) or Sprott, C3 Funds has created a closed-end fund that invests in smaller to medium-sized gold mines.

The fund lends capital to these mines, allowing them to increase production, and in return the mines repay the loan in physical gold at a discounted price.

This structure not only supports the mines in ramping up their operations, but also allows investors to benefit from a predictable revenue stream.

Christopher Werner highlighted that this approach provides a sweet spot between high-risk, high-reward junior gold exploration companies and the low-risk, high-cost option of holding precious metal.

C3 Funds’ strategy is attractive to investors seeking stability with modest returns, backed by the tangible value of physical gold.

C3 Funds offers a unique opportunity for accredited investors to access physical gold without the need for a large capital investment.

“Our minimum investment size is $25,000,” Duque said. This model democratizes gold investing, allowing more investors to participate without having to invest millions directly in a mine.

Through C3 Funds, investors receive gold when the principal of their loan is repaid, a return in physical form that is unusual in the market.

Risk management is key to C3 Funds’ approach. C3’s mining team of highly experienced geologists and qualified professionals conduct comprehensive assessments of each mine’s operations and finances before offering a loan.

Additionally, C3’s loans are backed by mining assets, further protecting investors. The fund mitigates risk by limiting exposure to producing mines only, with reserves documented through comprehensive National Instruments (NASDAQ:) 43-101 reports, which are standard in the mining industry.

The company’s model also benefits from rising global gold trends. Werner and Duque said factors such as geopolitical instability, inflation and central banks increasing their gold reserves have driven up demand and prices.

The company is also capitalizing on new opportunities with artisanal mining in South America, where more and more mines are looking for a path to compliance and profitability.

Each of C3 Funds’ five-year portfolios offers different opportunities for both mining companies and investors.

Once a loan is paid off, the mines are free to continue operations without any lingering financial ties. However, many mines find value in establishing long-term relationships with C3 Funds.

“So the whole concept develops this long-term relationship with the mines. We help them increase production. Now we have created a kind of healthy relationship,” Duque said.

Each fund has its own mining portfolio, creating a rotation of new investment opportunities.

Although C3 Funds is in the early stages of marketing its fund to accredited investors and will take off as the gold price rises, C3 Funds is positioning itself as a potentially innovative and safe income-generating asset in the market.