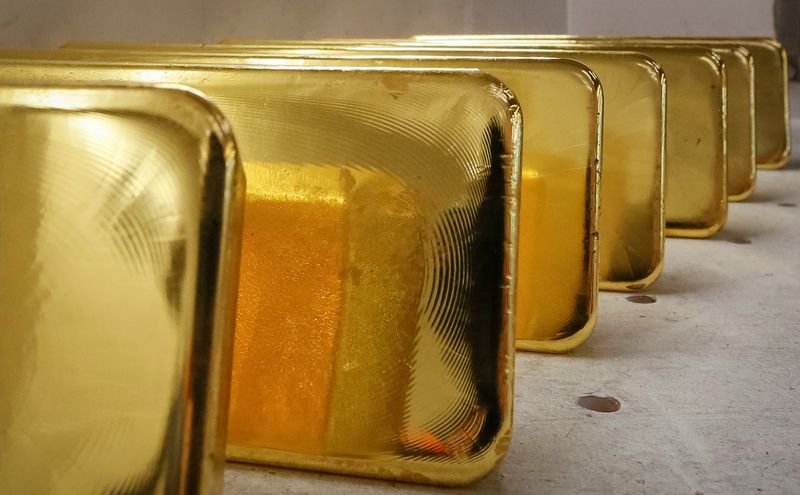

Investing.com–Gold prices rose in Asian trading on Friday but posted steep losses throughout the week as traders largely maintained a preference for the dollar ahead of more interest rate signals in coming days.

The yellow metal briefly hit record highs in July before a mix of profit-taking and volatility in commodity markets sent prices plummeting.

rose 0.3% to $2,371.23 per ounce, while the August maturity rose 0.7% to $2,369.90 per ounce at 00:43 ET (04:43 GMT).

Gold points to weekly loss with PCE data, Fed on tap

Spot prices fell 1.2% this week, after initially falling much further on Thursday following stronger-than-expected second-quarter data from the US.

These figures fueled hopes of a soft landing for the US economy – a scenario that could reduce demand for safe-haven gold.

Still, traders largely maintained their bets on a Federal Reserve rate cut in September, with future data – the Fed’s preferred inflation gauge – likely to play a role in the interest rate outlook.

Inflation is expected to decline further in June, albeit mildly. It also comes just days before a Fed meeting where the central bank is widely expected to keep rates steady and signal a rate cut in September.

Lower interest rates are a good sign for gold and precious metals as they lower the opportunity cost of investing in non-yielding assets.

The yellow metal could also see demand for safe havens increase as the US presidential race heats up, with recent polls pointing to a close race between Republican candidate Donald Trump and Democratic front-runner Kamala Harris.

Other precious metals were mixed on Friday but also posted steep losses this week. rose 0.4% to $948.0 per ounce, while the price fell 0.3% to $27,890 per ounce. Platinum fell 2.7% this week, while silver fell almost 5%.

Copper remains stable, but is in the red for the third week due to fears of a drop in demand

Among industrial metals, copper prices stabilized on Friday, but were in the red for the third week in a row on persistent concerns about sluggish demand, especially in top importer China.

The benchmark on the London Metal Exchange held steady at $9,123.50 per tonne, while the price rose 0.2% in one month to $4.1250 per pound. Both contracts fell by 2% and 2.6% respectively this week.

The red metal provided some relief to strong US GDP data, while a slew of surprise rate cuts in China also halted copper’s slide.