Investing.com — Gold prices rose slightly in Asian trading on Thursday, remaining near record highs, even as the dollar’s strength — following speculation about a second Trump presidency — weighed on broader metals markets.

Among industrial metals, copper prices posted fresh losses as a Chinese government briefing on real estate market support failed to impress.

A drop in government bond yields helped support gold, as did interest rate expectations from major central banks. The European Central Bank is widely expected to cut interest rates by 25 basis points later today.

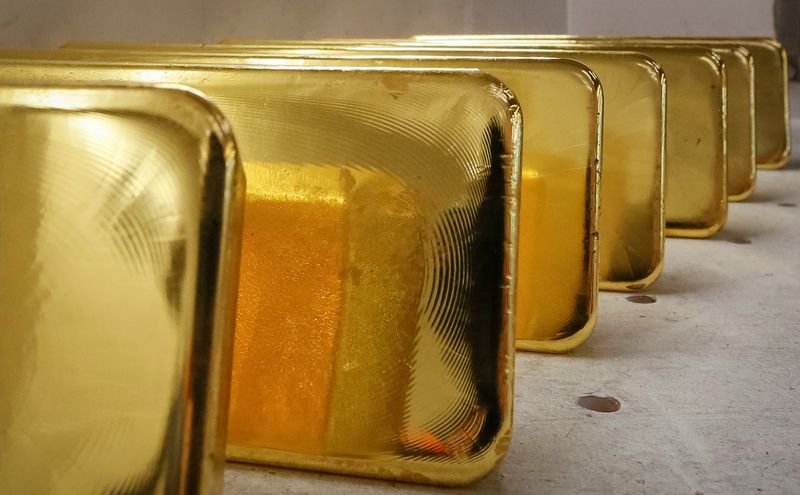

rose 0.2% to $2,678.90 per ounce, while the December term rose 0.1% to $2,694.40 per ounce at 00:23 ET (04:23 GMT).

Gold close to record highs amid softer rates, interest rate cuts eyed

Spot prices came within striking distance of a record high of $2,685.96 an ounce on Wednesday.

Bullion prices were supported by weakness in Treasury yields, down 0.5% on Wednesday amid increased speculation that Donald Trump will win a second term.

Trump was seen leading Vice President Kamala Harris in the online gambling markets, while recent media polls showed Harris slightly ahead. But with about three weeks to go until the votes, markets are gearing up for a tight race.

Trump’s policies are expected to be inflationary, a view that has depressed Treasury yields and pushed yields to their strongest levels since early August.

Markets also awaited further interest rate cuts from major central banks. The European Central Bank is widely expected to do so at the end of a meeting later on Thursday.

Other bullion prices were mixed. rose 0.5% to $1,012.40 per ounce, while it fell 0.7% to $31,760 per ounce.

Copper falls while Chinese real estate signals are disappointing

The benchmark on the London Metal Exchange fell 0.6% to $9,548.50 per tonne, while December fell 0.6% to $4.3445 per pound.

Both contracts extended recent losses after China’s latest briefing on economic support plans also largely disappointed. China’s housing minister outlined more measures on Thursday to help support the property market, including an expanded whitelist of developers with access to government financing.

But a lack of new features, along with scant details on the features’ implementation, disappointed investors hoping for more bumper measures.

Thursday’s briefing was the latest in a series of stimulus briefings from China as Beijing mobilizes more support for the economy. But previous briefings were also disappointing.

This caused copper to suffer steep losses last week, amid doubts about the world’s largest copper importer. The Chinese third-quarter figures will be released on Friday.