Investing.com–Gold prices fell within tight trading ranges on Wednesday, with the June holiday in the US limiting activity.

At 07:30 ET (11:30 GMT), the price was down 0.1% at $2,328.84 per ounce, while down 0.2% to $2,343.20 per ounce.

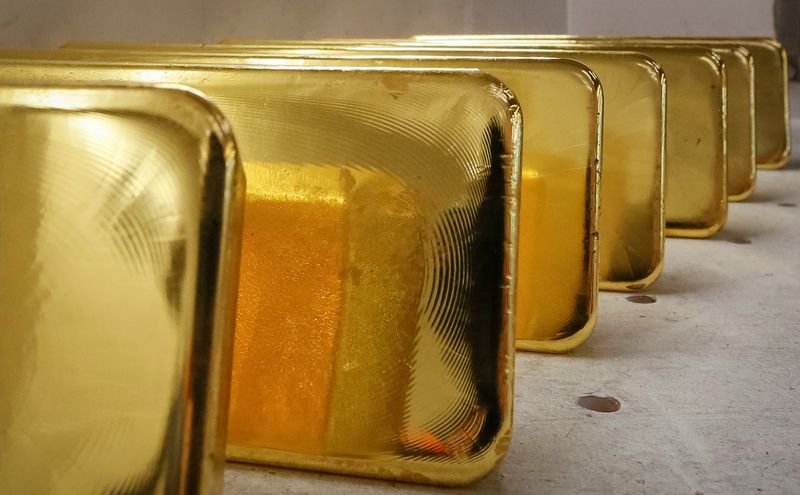

Gold ready to boost central bank

Gold and metals prices have retreated in recent sessions after the Federal Reserve said it expected to cut rates just once in 2024, compared with previous forecasts of three cuts.

This has boosted the dollar, making gold and other dollar-denominated commodities more expensive for foreign buyers, and increasing the opportunity cost of investing in non-performing assets.

Gold reached a high of nearly $2,450 an ounce in May, helped by strong demand from central banks amid concerns about geopolitical instability and persistent inflation.

Last year, central banks added the second-highest amount of gold ever: 1,037 tons. In 2022, a record 1,082 tons of gold were purchased by central banks.

More purchases are likely in the near future as the World Gold Council’s annual survey, which surveyed 70 central bankers, found that 29% of them plan to increase their gold reserves in the next twelve months.

That is the highest level since the annual survey began in 2018.

The other precious metals also traded within a tight range on Wednesday. rose 0.8% to $984.75 per ounce, while the price rose 0.1% to $29.598 per ounce.

Buyers are rebounding after recent sell-offs

Among industrial metals, copper prices rose on Wednesday, recovering slightly after falling to a two-month low earlier this week.

The benchmark on the London Metal Exchange rose 1.3% to $9,800.30 a tonne, while one-month copper futures rose 1.4% to $4.5550 a pound.

The drop in copper prices comes amid disappointing industrial production data from China, the metal’s biggest market, as the housing and construction slump worsens in the world’s second-largest economy.

Copper prices hit a record high above $11,000 a tonne in May this year, but have cooled rapidly on concerns about rising global inventory levels and weakness in China.