By Nick Carey

LONDON (Reuters) – The European Commission’s decision to impose tariffs on imported Chinese EVs could have far-reaching consequences for European carmakers as a potential trade war would hit not only their business in China but also their own imports of Chinese-made cars.

German automakers in particular have a lot to lose in China and Wednesday’s announcement leaves them mulling over a decision that BMW (ETR:) CEO Oliver Zipse described as the “wrong path.”

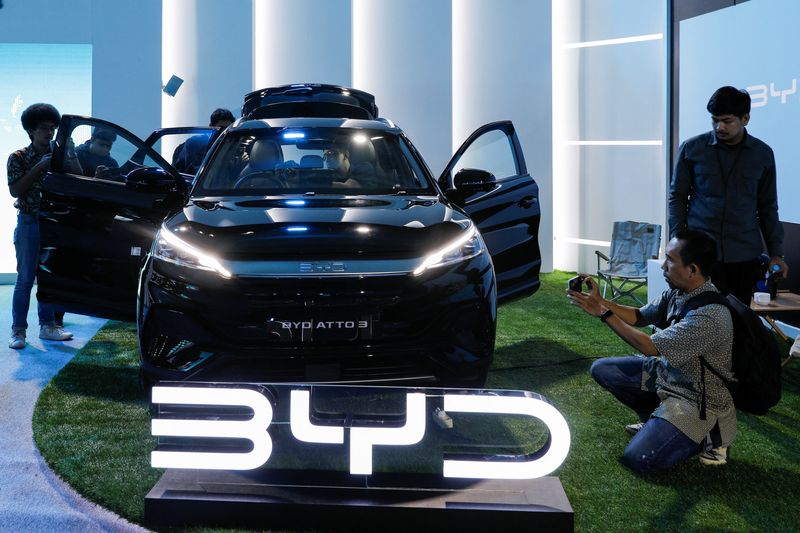

Tariffs of up to 38.1% – amounting to billions of euros – will be imposed on Chinese-made electric vehicles from July, but this is unlikely to deter Chinese carmakers from exporting to Europe as they can bear the extra costs and still be able to make a profit.

Most Chinese automakers remained silent after the tariffs were announced, but EV maker Nio (NYSE:) said that while it opposed the decision, its commitment to the EV market in Europe remains steadfast.

China’s BYD (SZ:) and Chery have also already announced plans to build cars in Europe, which would avoid the tariffs.

Will Roberts, head of automotive research at Rho Motion, said that while Chinese automakers have room to absorb tariffs, the “real test of today’s announcement will be whether Beijing will retaliate in kind.”

“European manufacturers are still dependent on the Chinese market, so declining profits from the East would only slow down their ability to effectively transition to electric vehicles,” he added.

HIGH STAKES

For the German car manufacturers, it has become a high-stakes game.

China accounted for almost 32% of BMW’s first-quarter sales and about 30% at rivals Volkswagen (ETR:) and Mercedes-Benz (OTC:).

VW shares fell 1.2% on Wednesday, one of the biggest decliners on the euro zone’s blue-chip stock index, BMW fell 0.9% to its lowest level since November and Mercedes fell 0.5% at the weakest level since February.

So retaliation could be painful for those companies and Germany’s manufacturing economy, prompting Chancellor Olaf Scholz to warn during a speech at an Opel factory last weekend that “isolationism and illegal customs barriers… ultimately make everything more expensive and everyone poorer.” to make. “

VW said the “negative effects” of the tariffs “outweigh the potential benefits for the European and especially the German car industry”.

Mercedes CEO Ola Kaellenius said the “dismantling of restrictions and the expansion of fair and free trade has led to economic growth. So we shouldn’t go in the other direction now.”

But the tariffs will also affect the cars that European carmakers have made in China for European consumers.

Renault (EPA:), for example, imports the affordable, Chinese-made Dacia Spring EV into Europe, and its Chinese joint venture partner Dongfeng is on the list of companies likely to face a 21% tariff.

Renault did not comment on the EU’s tariff announcement.

Tesla (NASDAQ:) imports Chinese-made electric cars into Europe and BMW imports mini-EVs and the iX3.

The European automotive industry is also dependent on Chinese components, especially for electric vehicles, as China dominates much of the supply chain.

Speaking to analysts last month, BMW CEO Zipse warned that provoking a trade war could have serious consequences for the transition to electric cars, as it is impossible to make cars in Europe without Chinese imports.

“There is no Green Deal in Europe without resources from China,” Zipse said.