By Moayed Kenany, Timour Azhari and Adam Makary

BAGHDAD (Reuters) -Chinese companies won bids on Saturday to explore five Iraqi oil and gas fields in a hydrocarbon exploration licensing round aimed mainly at boosting gas production for domestic use.

An Iraqi Kurdish company also took two of the 29 projects up for grabs in the three-day licensing round in central, southern and western Iraq, which for the first time includes an offshore exploration block in the country’s Arabian Gulf waters.

Iraq wants to attract billions of dollars in investments to develop its oil and gas sector, while the country aims to boost local petrochemical production and end imports of gas from neighboring Iran, which is currently crucial for energy production .

More than twenty companies pre-qualified for the licensing round, including European, Chinese, Arab and Iraqi groups.

Notably, no U.S. oil giants were involved, even after Iraqi Prime Minister Mohammed Shia met with representatives of U.S. oil companies during an official visit to the United States last month.

Five bids were won by Chinese companies on Saturday.

Zhongman Petroleum and Natural Gas Group (ZPEC) has taken the northern extension of the Eastern Baghdad field, in Baghdad, and the Middle Euphrates field spanning the southern provinces of Najaf and Karbala, the Oil Ministry said.

China’s United Energy Group Ltd won a bid to develop the Al-Faw field in southern Basra, while ZhenHua won a bid to develop Iraq’s Qurnain field in the Iraqi-Saudi border area and Geo-Jade won a bid to develop Iraq’s Zurbatiya field in the Iraqi border area. Was it.

Remove ads

.

Two oil and gas fields have been seized by Iraq’s KAR group: the Dimah field in Iraq’s eastern Maysan province and the Sasan & Alan fields in Iraq’s northwestern Nineveh province, the ministry said.

About 20 projects are still open for bidding on Sunday and Monday.

Falah Al-amri, the Iraqi prime minister’s adviser on oil and gas issues, said the government hoped the new projects would increase oil production from about 5 million barrels a day to 6 million barrels now by 2030.

The government also wants the projects to produce enough so that, along with plans to virtually eliminate gas flaring by 2030, Iraq can end imports.

“It is too early to talk about (gas) exports. We want to become self-sufficient,” Al-amri told Reuters.

Iraq, OPEC’s second-largest oil producer after Saudi Arabia, once aimed to become a rival to the Gulf Arab kingdom with output of more than a tenth of global demand.

But the development of the oil sector has been hampered by contract terms seen as unfavorable by many major oil companies, as well as recurring conflict and political paralysis.

Increasing investor attention in recent years to environmental, social and governance criteria has also had an effect.

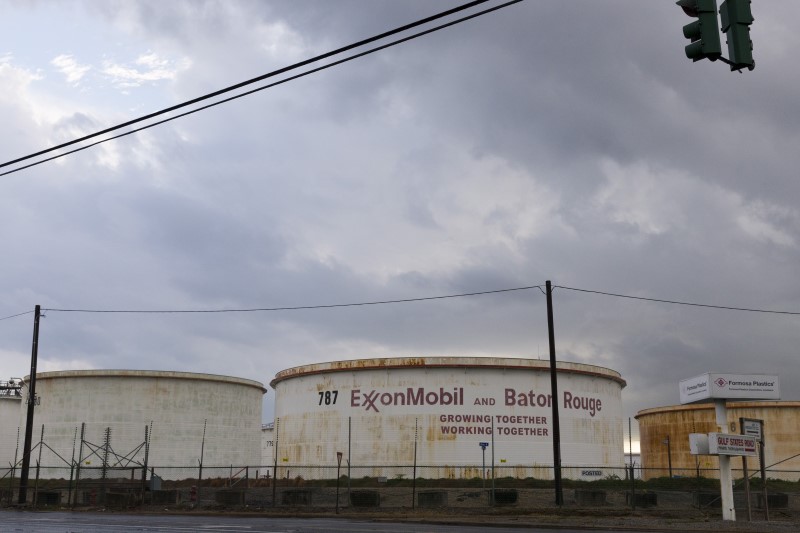

Western oil giants such as ExxonMobil Corp (NYSE:) and Royal Dutch Shell (LON:) Plc have deviated from a number of projects in Iraq, while Chinese companies have steadily expanded their footprint.