Investors should consider buying gold as geopolitical tensions in the Middle East are likely to escalate in the coming months, according to a recent note from Alpine Macro.

The research firm warns that Iran, feeling pressure to restore deterrence, may soon launch limited attacks on Israel, either directly or through proxies.

They note that while Western, Arab and Russian influences are currently holding Iran back, the situation remains volatile.

Alpine Macro suggests that Israel’s threat to retaliate disproportionately, possibly targeting Iran’s nuclear facilities or oil infrastructure, could be an important factor in deterring Iran from a large-scale attack.

However, the company believes that some form of retaliation from Iran is likely.

They also argue that there is a “tail risk” that Iran would take an unexpected action, such as declaring itself a nuclear power, which would dramatically change the regional balance of power and pose even more risks.

The note emphasizes that the conflict in the Middle East has a “high probability of escalating in the next six to nine months,” which would likely increase energy prices and increase the value of energy assets outside the region.

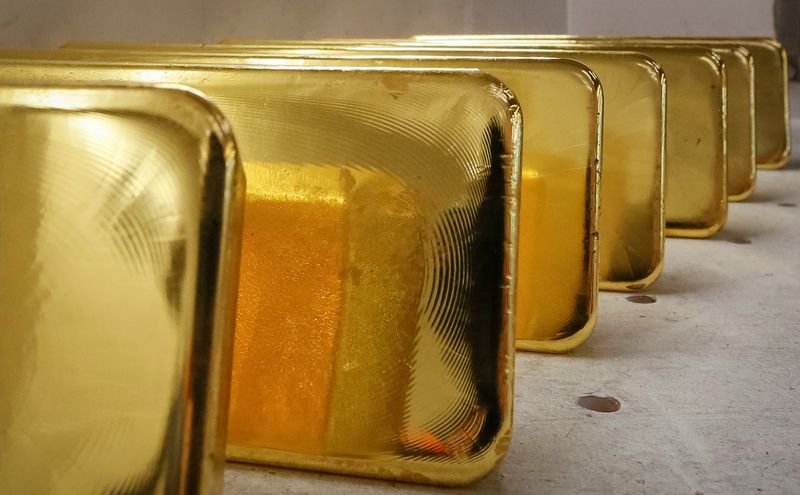

Given these uncertainties, Alpine Macro’s Chief Asset Allocation Strategist strongly recommends maintaining exposure to gold.

He argues that gold remains the best hedge against geopolitical risk, citing historical data showing that gold typically outperforms other safe haven assets in the months following major geopolitical events.

In light of increasing geopolitical risks, Alpine Macro advises investors to maintain or increase their positions in gold as a protective measure against potential volatility.