By Tom Westbrook, Elizabeth Howcroft and Chibuike Oguh

NEW YORK/SINGAPORE/PARIS (Reuters) -Bitcoin, the world’s largest cryptocurrency, neared the previous session’s record high in choppy trading on Tuesday, as the top U.S. markets regulator unveiled a plan to overhaul rules for the sector .

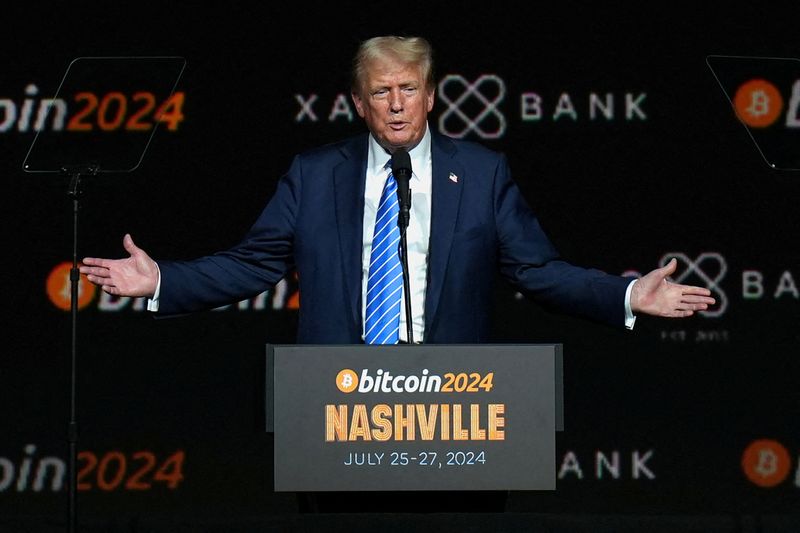

hit an all-time high of $109,071 on Monday when Trump, who promised to be a “crypto president,” was sworn in, but sank when crypto wasn’t included in a series of executive actions on day one.

Bitcoin prices rose 3.8%, while the second-largest cryptocurrency rose 1.4% as the market shook off some of that disappointment.

The new leadership of the Securities and Exchange Commission said Tuesday it had created a task force to develop a regulatory framework for digital assets, the first major step by the new Trump administration to overhaul crypto policy.

“The president has moved quickly on his agenda,” Coinbase (NASDAQ:) Chief Legal Officer Paul Grewal said in a telephone interview. “The SEC has made it clear that they understand that and want to be a part of that.”

However, some analysts warned of volatility until the Trump administration starts announcing concrete policies that the crypto industry has long hoped for.

“The digital asset market is disappointed that it was not mentioned in the inauguration speech or Day One executive orders,” said Geoffrey Kendrick, global head of digital asset research at Standard Chartered (OTC:).

“I suspect Bitcoin will eventually decline as long as we don’t get any news from Trump on digital assets. A decline below $100,000 seems inevitable.”

Trump’s own $TRUMP-branded “meme coin,” which launched Friday evening, fell on Tuesday, according to cryptocurrency price tracker CoinMarketCap.

World Liberty Financial, a separate Trump-linked crypto project, also said Monday that it had completed an initial token sale, raising $300 million, and that it would issue additional tokens. Trump has pledged to hand over management of his assets to his children, but ethics experts have criticized his crypto ventures for raising conflicts of interest and fueling speculation in a volatile asset class.

Acting SEC Chairman Mark Uyeda’s office said Tuesday that the agency’s new task force would help draw clear regulatory lines, provide pathways to registration, develop disclosure frameworks and deploy enforcement resources.

Reuters reported earlier this month that Uyeda and fellow Republican commissioner Hester Peirce were about to initiate the crypto policy review.

Trump is also still expected to issue executive orders in the coming days that will further promote Bitcoin adoption, Reuters and other media have reported.

Speaking to the Reuters Global Markets Forum at the start of the World Economic Forum’s annual meeting in Davos, Jeremy Allaire, CEO of stablecoin publisher Circle, said he expects imminent executive orders that could allow banks to crypto to trade, offer crypto investments to wealthy clients and hold it in wallets.