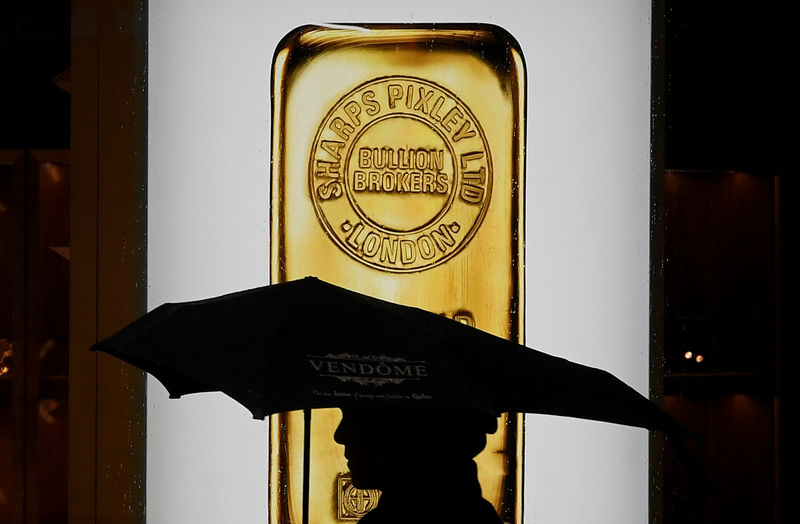

Investing.com- Gold prices were higher on Thursday as ongoing geopolitical tensions and a weak dollar boosted demand for the yellow metal.

rose about 0.6% to $2,632.84 per ounce, while February expiration at 1:11 PM ET (18:11 GMT) rose 0.6% to $2,650.64 per ounce.

Geopolitical tensions in the Middle East also contributed to bullion’s gains.

Palestinian militant group Hamas and Israel accused each other on Wednesday of obstructing a ceasefire deal, with Hamas blaming Israel for imposing additional conditions and Israeli Prime Minister Benjamin Netanyahu claiming Hamas had reneged on previous agreements.

Gold is seen as a safe haven amid market uncertainties.

US dollar lower, but remains near two-year highs as unemployment benefits surprise on the downside

It was flat on Thursday, but continued to hover near a two-year high reached last week after data showed fewer U.S. jobless claims than expected for the week ending Dec. 21.

In the week ending December 21, 219,000 people filed for unemployment insurance, a decrease of 1,000 from the previous week and lower than estimates of 223,000.

But continuing claims rose by 46,000 last week to 1.910 million, which was “the highest pressure for continuing claims since the week ending November 12, 2021,” Jefferies wrote in a note.

The dollar pared some losses to remain flat as Treasury yields posted gains on expectations of less dovish Fed policy.

Higher interest rates put downward pressure on gold because, as the opportunity cost of holding gold rises, it becomes more attractive compared to interest-bearing assets such as bonds.

The yellow metal has seen marginal moves this week, after losing more than 1% the week before, due to uncertainty over the metal’s prospects

Other valuables were mixed in Thursday. fell 0.7% to $953.35 per ounce, while rising 0.2% to $30.34 per ounce.

Copper tightens Chinese stimulus measures

In industrial metals, prices rose after a Reuters report showed that Chinese authorities plan to issue a record 3 trillion yuan ($411 billion) in special government bonds next year, in an intensified fiscal effort to boost a struggling economy to stimulate.

Analysts also attributed copper’s weakness to seasonal sluggishness, as industrial production and construction projects often slow as companies and projects prepare for year-end closures and holidays.

The most traded copper contract in January on the Shanghai Futures Exchange (SHFE) rose 0.2% to 74,060.00 yuan per tonne.

Benchmark copper contracts on the London Metal Exchange were closed on Thursday for the holiday.

(Ayushman Ojha continued with this report.)