Investing.com – Gold prices fell in European trading on Tuesday as the dollar strengthened sharply amid speculation about the policies of Donald Trump’s incoming administration.

Improved risk appetite following Trump’s election victory last week sapped gold’s safe-haven demand. A sharp rally in the dollar also put pressure on precious metal prices.

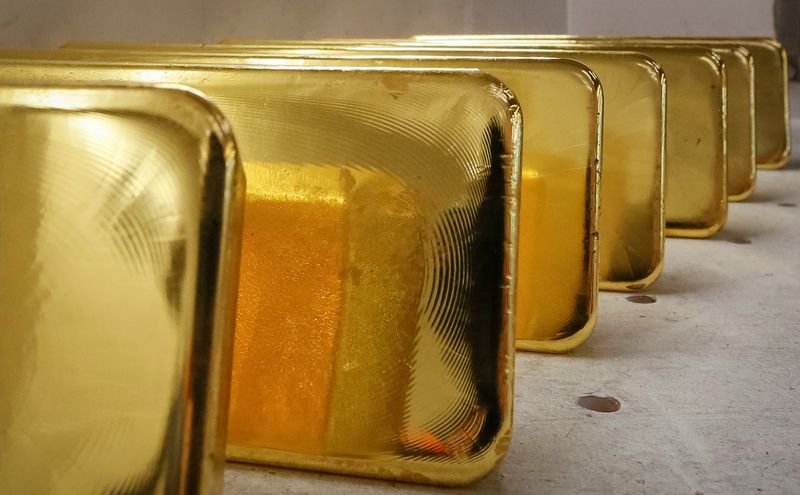

fell 0.9% to $2,595.56 per ounce, while the December expiration fell 0.6% to $2,601.55 per ounce at 06:52 ET (11:52 GMT).

Spot prices have fallen from record highs of nearly $2,800 an ounce in the past two weeks. Sentiment around gold has been dented by a spike in the dollar, driven by expectations that Trump’s inflation policies will keep interest rates high in the long term.

Some economists have argued that Trump’s protectionist stance on trade, including a blanket tariff on U.S. imports, could reignite recently waning inflationary pressures.

The dollar shot to a four-month high this week, while Treasury yields, which tend to move inversely to prices, also rose higher.

Investors are now focusing on key US consumer price data, which could indicate that inflation remained stubborn in October.

In addition to this talk, a slew of Federal Reserve officials will also speak in the coming days, providing more possible clues on interest rates after the central bank cut borrowing costs by 25 basis points last week.

Traders were pricing in a 66.7% chance of another quarter-point cut in December, and a 33.3% chance it will remain unchanged, the closely watched CME FedWatch Tool showed.

“The rapid decline in gold prices after the election ran counter to our strategists’ expectations, but they think the sell-off is a stumble and not a major change,” JPMorgan Chase (NYSE:) analysts said.

“Additionally, the sell-off was driven by near-term position doubling in well-underwritten pre-election trading, rather than a break in their thesis that a Republican gubernatorial battle in 2025 is likely to continue fueling further upside for gold as the humiliating trade rumbles on.”