By Clyde Russel

LAUNCESTON, Australia (Reuters) -Western and Chinese investors reacted differently to Beijing’s latest stimulus announcements, and it is likely that both groups are somewhat missing the point.

At what was a much-anticipated press conference on Saturday, the Finance Ministry said it was prepared to significantly increase spending but did not put the yuan in its considerations.

It appears Western investors were disappointed not to receive any funding, while their Chinese counterparts believed Beijing remains determined to pull the world’s second-largest economy out of its growth slump.

The difference can be seen in price movements in early Monday trading in copper, the main industrial metal used in construction and manufacturing.

Shanghai opened higher, gaining as much as 0.5% to a high of 77,700 yuan ($10,990) per tonne on Monday.

Their counterparts in London moved in the opposite direction in early trading, falling as much as 1.1% to $9,683 a tonne.

While not massive moves, they do show that Chinese investors seemed willing to give Beijing the benefit of the doubt on the coming stimulus measures, while Western investors need to be convinced that enough will be done.

It’s worth looking at the details of what was announced this weekend, with three of the four measures aimed at easing the financial burden on local authorities, the bodies responsible for around 80% of all government expenditure.

What Beijing is essentially proposing is to refinance mountains of local government debt, and by doing so these authorities can take out new loans and use the money to kick-start construction and infrastructure projects.

Reviving the ailing real estate sector is key to reviving China’s economy as it will boost consumer confidence while increasing physical demand for raw materials, especially steel and copper, but also for refined fuels such as diesel.

CHAIN PRIZE WIN

Steel reinforcement futures in Shanghai responded positively to the weekend news, rising as much as 2.2% to 3,531 yuan per tonne in early trading on Monday.

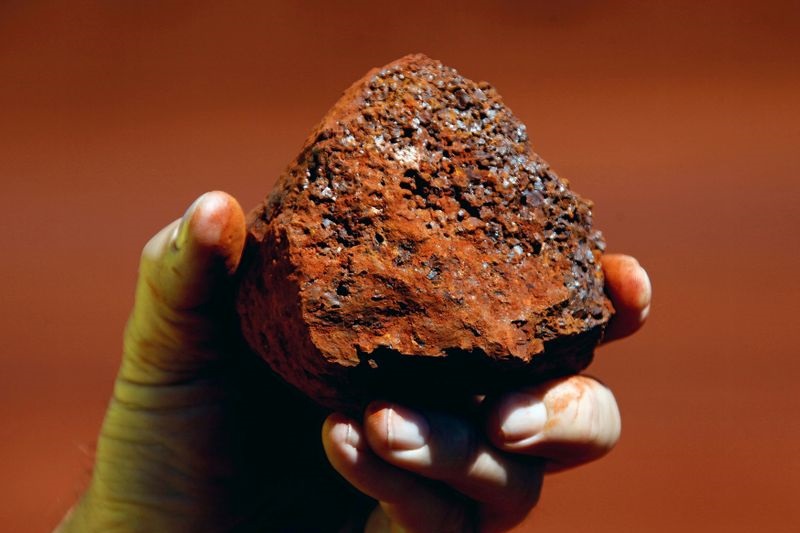

Iron ore contracts on the Dalian Commodity Exchange rose as much as 3.2% to an intraday high of 810 yuan, but futures on the Singapore Exchange (OTC:) rose a much more muted 1.4% to $107.90.

Iron ore futures in Dalian have risen about 23% since a low of 658 yuan per tonne on September 23, ahead of the start of the latest round of stimulus measures.

In contrast, Singapore Exchange contracts, which are traded more by investors outside China, rose a more modest 16.5%.

In some ways, the gains are difficult to justify on a fundamental basis, as Chinese stimulus is unlikely to result in a significant increase in demand for the key steel commodity.

China’s steel mills are unlikely to ramp up production in the final quarter of 2024, given weak margins and still weak steel demand.

Even if Beijing’s stimulus measures prove to be the antidote for the struggling real estate sector, it is more likely that demand will only increase in the first half of 2025.

There are also significant risks to the Chinese economy that are largely beyond Beijing’s control, such as a global trade war if Donald Trump is successful in his bid to win the US presidential election next month.

What is clear is that China’s stimulus package is incomplete, so increases in the prices of some commodities on the country’s local exchanges remain largely sentiment-driven.

But it also appears that China’s leaders are ramping up the rhetoric and moving closer to promising to do whatever it takes to boost the economy.

The trick for them will be to offer incentives that will both deliver real-world success through increased activity, and still win over cautious investors.

The opinions expressed here are those of the author, a columnist for Reuters.