Investing.com — Asian shares rose Thursday, following overnight gains on Wall Street, as a series of weak economic data led investors to increase bets that the Federal Reserve would cut interest rates by September.

Japanese shares have been the best performers in recent sessions. They were able to recover most of their losses in the second quarter and return within sight of record highs.

Regional markets followed Wall Street’s strength overnight, where the and hit record highs in holiday-shortened trading after weak and boosted bets following a 25 basis point cut in September.

But the June Fed meeting tempered this optimism somewhat, with US stock index futures moving sideways in Asian trading. The anticipation of Friday’s most important figures also ensured that sentiment remained cautious.

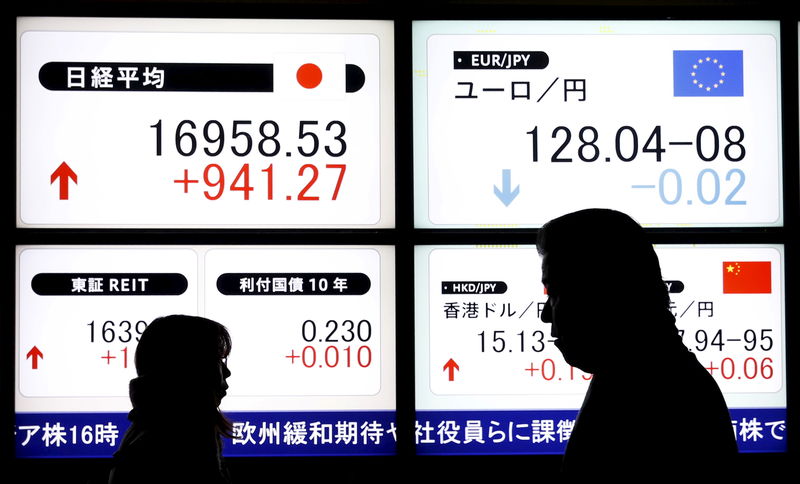

Japan’s Nikkei, TOPIX test record highs

The Japanese index and the index rose 0.2% and 0.5% respectively on Thursday.

The Nikkei had surpassed the 40,000 level for the first time since April earlier this week and was close to record highs in the first quarter.

The broader TOPIX briefly reached a record high of 2,890.47 points.

Japanese markets surged last week as a slew of weak economic data weighed on the yen and raised expectations that the Bank of Japan will have limited room to tighten policy.

Investors largely ignored the potential headwinds for corporate earnings from weakening Japanese economic growth. Earlier this week, the government downgraded first-quarter gross domestic product data, showing a much deeper contraction in growth than initially expected.

Gains in Japanese markets were also driven by technology stocks, which followed a rally in their US peers on artificial intelligence hype.

Asian shares are supported by interest rate cuts in September

Broader Asian markets advanced as conviction grew that the Fed will cut rates in September. Stock traders estimate a nearly 66% chance of a 25 basis point cut, compared to previous estimates of a 59.5% chance yesterday.

South Korea’s rose 0.7%, while Australia’s rose 1.1%. Data from Australia showed the country’s figures fell more than expected in May.

Indian index futures pointed to a positive opening after the Nifty and scaled hit record highs this week.

China lags behind as economic turmoil continues

China and the indexes lagged their peers and fell slightly as concerns about a slowing economic recovery continued. Losses in the mainland stock markets caused Hong Kong’s index to fall slightly.

Sentiment towards China showed little sign of improvement after private purchasing managers’ index data showed weaker-than-expected growth in the .

A slowdown in stimulus from Beijing also raised doubts about how much more supportive measures the government has in store.

The focus now is on the Chinese Communist Party’s Third Plenum – a meeting of top officials expected to provide more clues about China’s economy.