By Makiko Yamazaki and Satoshi Sugiyama

TOKYO (Reuters) – Japan appointed a new top foreign exchange diplomat on Friday after the yen hit a 38-year low against the dollar. This raised expectations of an upcoming market intervention by Tokyo to support the battered currency.

Atsushi Mimura, a veteran of financial regulation, replaces Masato Kanda, who this year launched the biggest ever yen-buying intervention and aggressively stopped speculators from pushing the Japanese currency down too much.

Although the change is part of a regular workforce reshuffle that takes place every year, it comes as markets are testing Japan’s resolve to halt another yen decline, causing additional pain for households and businesses. does by raising import costs.

“Kanda seemed aggressive, given his comments that authorities were ready to intervene at any time of the day,” said Hideo Kumano, chief economist at Dai-ichi Life Research Institute, adding that his departure could affect the way Japan communicates. its currency policy.

“But that’s hard to say until we see how his successor drives policy. Overall, I don’t think the broad policy direction will change much.”

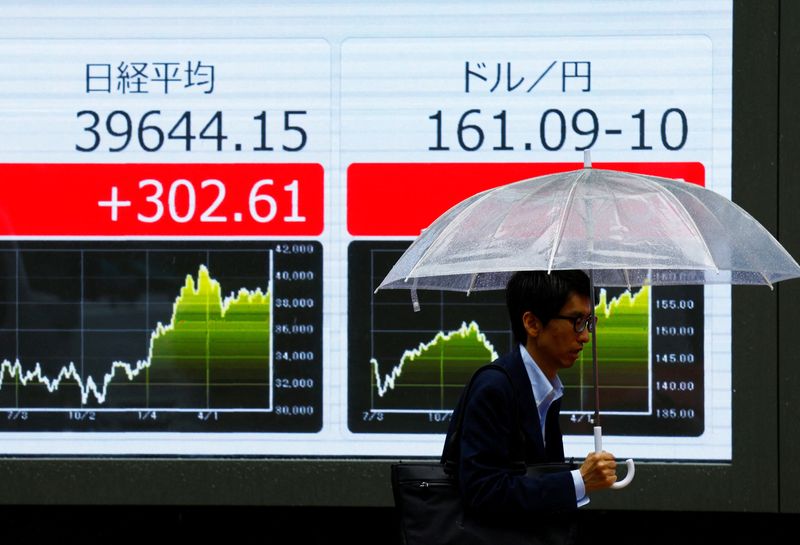

Japanese officials reiterated their warnings as the yen fell past 161 per dollar on Friday, well below the level that prompted the last intervention period in late April and early May.

“Excessive volatility in the foreign exchange market is undesirable,” Finance Minister Shunichi Suzuki told a news conference on Friday, adding that authorities will “respond appropriately” to such moves.

He also said authorities were “deeply concerned” about the impact of the yen’s “rapid and unilateral” movements on the economy.

Japanese authorities are facing renewed pressure to halt the yen’s sharp declines as traders focus on the interest rate differential between Japan and the United States.

A weaker yen is a boon for Japan’s exporters but a headache for policymakers as it raises import costs, increases inflationary pressures and puts pressure on households.

Under Kanda, who served as an FX diplomat for three years, Tokyo spent 9.8 trillion yen ($60.85 billion) on foreign exchange market interventions in late April and early May, after the Japanese currency hit a then 34-year low. had reached 160.245 per dollar. April 29.

The yen traded at 161.27 per dollar on Friday, its weakest since 1986, ahead of crucial US inflation data due later in the day that could increase market volatility.

Market players expect the next line in the authorities’ sand to be somewhere around 164.50.

“If authorities want to prevent the yen from crossing that threshold, they will likely intervene before the currency reaches that level,” said Daisaku Ueno, chief FX strategist at Mitsubishi UFJ (NYSE:) Morgan Stanley Securities.

NEW DIPLOMAT

Mimura’s appointment will take effect on July 31, following the meeting of the group of 20 finance ministers and central bank governors in Rio de Janeiro on July 25.

However, little is known about his stance on currency policy. The 57-year-old, currently head of the ministry’s international bureau, will become deputy finance minister for international affairs – a position that oversees Japan’s currency policy and coordinates economic policy with other countries.

Having spent nearly a third of his 35-year government career at Japan’s banking regulator, Mimura has expertise and international ties in financial regulation.

During his three-year stint at the Bank for International Settlements in Basel, Mimura helped set up the Financial Stability Board to reform financial regulation and supervision in the midst of the 2008-2009 global financial crisis.

At the Finance Ministry last year, he worked on revising the Japan Bank for International Cooperation law to expand the state-owned bank’s reach and make foreign companies that play key roles in Japan’s supply chains eligible for loans from the couch.

Mimura was also part of a government team that briefed foreign investors on revisions to foreign ownership rules in 2020 to dispel the idea that stricter rules were intended to discourage foreign investment in Japan.

($1 = 161.0600 yen)