When Chloé Daniels was 28 years old in 2019, she made the biggest financial mistake of her life. She gave her then-boyfriend about $30,000 in just over a year as an “investment” in his company that refurbished homes in the Chicago area.

“It was my entire savings at the time,” says Daniels, now 32. “I didn’t even have an emergency fund. And every time I had money, I invested again. I just kept pumping more money into it.”

When the pandemic hit, the house flipping operation fell apart. Labor costs have skyrocketed. Lumber prices skyrocketed. It didn’t take long before the relationship also fell apart.

Daniels quickly realized that she would never get back her initial $30,000 investment. To this day, she says she never made the money back.

“I didn’t know anything about investing at the time,” Daniels says.

The experience spurred Daniels to learn best practices in investing and personal finance, a knowledge she applied in her current role as a full-time financial educator at her company. Clo bare money coach.

“After choosing the riskiest investment I could ever make, I don’t want to risk my money that way,” says Daniels.

Since 2023, Daniels has attracted a legion of mostly Gen Z and millennial followers on social media by teaching people “how to invest the lazy way.” Her content, courses and webinars focus on learning how to automate savings and create simple portfolios with low-cost funds.

Instead of betting on hot stocks, buying gold, or even investing in super-risky private money lending, Daniels emphasizes a “set-it-and-forget-it” approach to building wealth. She has created dozens of videos explaining the benefits of Roth IRAs and the historically positive long-term returns of buying index funds.

“My approach is still aggressive – the majority of my portfolio is all equities – but it is a more proven approach to investing,” she says.

Her current philosophy that index funds are best for most investors — an idea touted by investing legend Warren Buffet as well as a growing number of financial influencers — is a stark departure from the risky gamble with her ex’s real estate venture.

As Daniels notes in an April 2023 video, “The lazy way I invest is much simpler, much less risky, and incredibly easy.”

Daniels’ ‘lazy’ investment strategy explained

Daniels is a big proponent of using tax-advantaged retirement accounts like 401(k)s and individual retirement accounts (IRAs) to build simple portfolios with a handful of low-cost index funds.

An index fund acts as a collection of stocks, offering investors instant diversification when purchasing a single stock. Take the S&P 500, for example, which tracks the 500 best-performing companies in the US. By purchasing an S&P 500 index fund, you gain partial ownership of all the companies the index tracks, from Apple and Microsoft to Coca-Cola and Disney.

You can buy low-cost index funds as an exchange-traded fund (ETF) or as a mutual fund. Both function very similarly, although some 401(k) plan platforms only allow you to purchase mutual funds, while ETFs are generally available from all brokers that allow stock trading.

Index funds are considered less risky than picking individual stocks because your money is spread across hundreds of companies instead of just one or two. Most are also cheap, with the best index funds having an expense ratio of less than 0.03 percent, or $3 for every $10,000 invested.

Daniels started her investing journey in earnest by maxing out her 401(k) retirement plan in 2020 while working full-time as a communications specialist at an engineering firm. She deposited about 25 percent of her six-figure salary into the account and earned a company match, which is essentially free money.

Since then, she’s expanded her investment accounts, adding a Roth IRA, traditional IRA, solo 401(k), a taxable brokerage, and even investing the money in her health savings account. As of March 2024, her net worth was $296,000, according to documents reviewed by Bankrate.

But she has used the same low-cost, passively managed funds to build wealth in all her accounts.

These are the main funds Daniels uses in her investment accounts:

- QQQ: Invesco QQQ Trust (Nasdaq)

- VTSAX: Vanguard Total Stock Market Index fund

- VOO: Vanguard S&P 500 ETF

- GUARDIAN: Vanguard S&P 500 Growth Index Fund ETF

- VOOV: Vanguard S&P 500 Value Index Fund ETF

- VIMAX: Vanguard Mid-Cap Index Fund

- VIOG: Vanguard S&P Small-Cap 600 Growth Index Fund ETF

Investing on autopilot

Daniels not only keeps her portfolio simple, she also puts her contributions on autopilot.

By transferring a percentage of her income directly to her investment accounts each month, she practices dollar-cost averaging, a strategy in which you invest a fixed amount at regular intervals. This helps buy more shares when prices are low and fewer when prices are high, smoothing out the impact of market turbulence without trying to time the market – a notoriously difficult task.

“If the guys on Wall Street — who not only have more education but also more access to information — can’t consistently time the market correctly, then I’m not going to do it,” Daniels says.

If consistently buying index funds sounds super boring, that’s the whole point.

“We have movies like ‘Wolf of Wall Street’ or ‘Dumb Money’ that make us think investing is like gambling: It’s day trading, it’s super risky,” Daniels says. “There isn’t a single movie about index funds because it isn’t exciting. It’s very boring.

“’Oh, index funds are doing well again’ doesn’t exactly make for exciting headlines,” Daniels adds.

Investing instead of paying off student loans with low interest rates

While the idea of consistently buying low-cost index funds isn’t new, Daniels has a somewhat unconventional attitude toward investing and paying down debt.

Unlike some voices in the personal finance world, Daniels says there are more important things than being completely debt-free as quickly as possible.

It’s a position that stands in stark contrast to influencers like radio host Dave Ramsey, who built a multi-million dollar financial education empire on the premise that people should eliminate all debt before ever putting money into the stock market.

“That’s a crazy idea,” says Daniels. “There is so much between ‘being debt free’ and ‘investing alone’. I think you should do both.”

Daniels believes that paying off high-interest credit card debt is essential, but as she notes, most millennials and Gen Zers are saddled with tens of thousands of dollars in low-interest student loan debt.

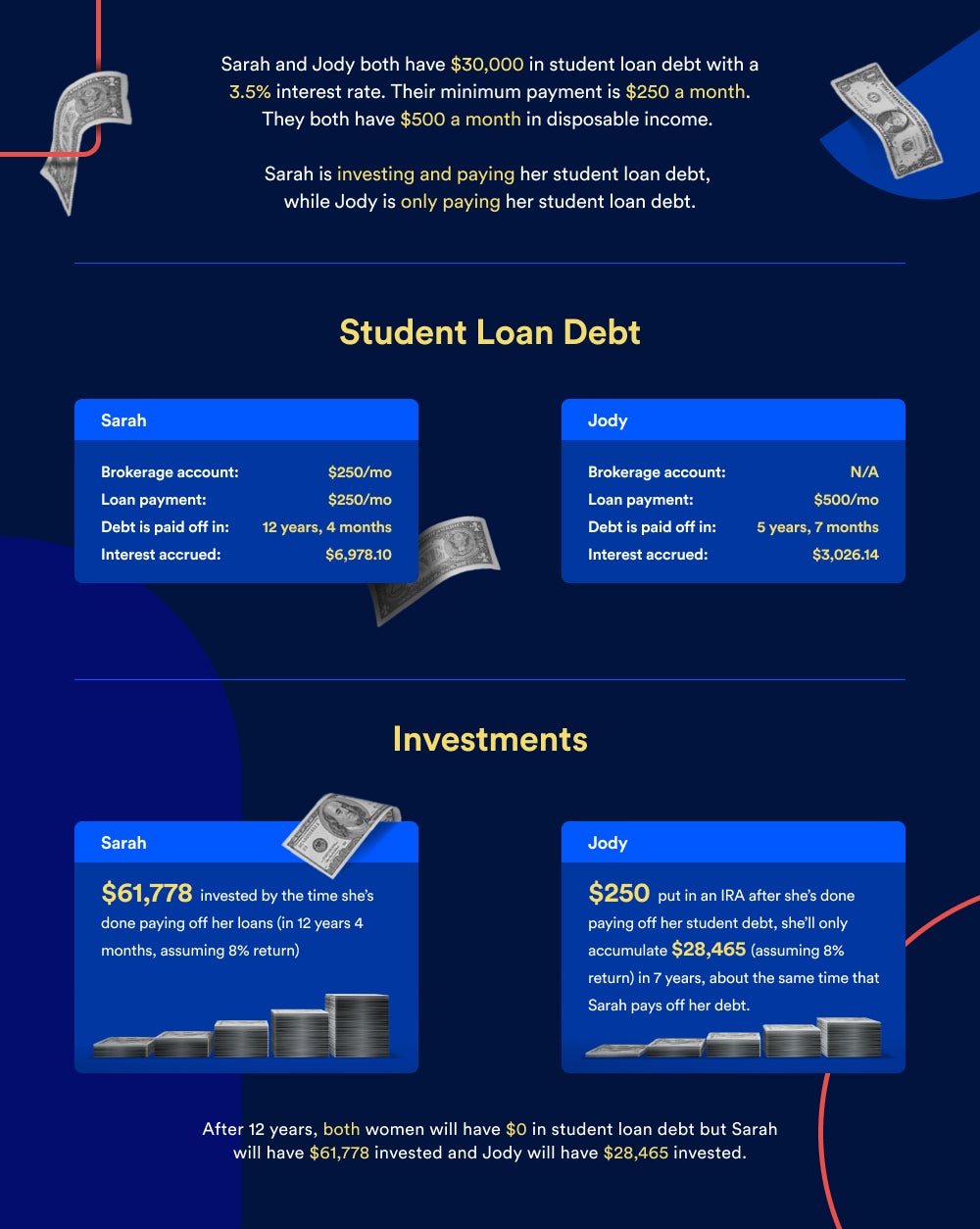

She thinks it often makes more sense to make a small or minimal payment on student loan debt — as long as interest rates stay below 5 to 8 percent — and invest at the same time.

Putting extra money into the market instead — especially in your 20s or 30s, when the power of interest compounding really is on your side — can yield better returns over time, Daniels says, even taking into account interest charges.

That’s because the stock market has historically averaged returns of 8 percent or more, while low-interest student loan debt may only charge interest of 4 percent or less. It won’t cost you much to hold that debt, but you will miss out on the potential growth if you invest at least some of your money.

“If you go through different scenarios, you can see if it makes sense to decide if you want to pay off your debt early, do I want to do a combination of both or do I just want to (make the minimum payments) and invest,” says Daniëls.

Daniels acknowledges that she didn’t take this approach in her late 20s, when she paid off nearly $40,000 in student loans in two years. She calls it her “debt-free mistake” and her other biggest financial regret.

“I did the calculations and it cost me about $1 million in the long run,” Daniels says. “Yes, I saved about $18,000 in interest by paying off that much debt when I did that. But I don’t think anyone would really choose to save $18,000 in interest over making $1 million over time.”

Daniels still has about $10,000 in student debt at 3.5 percent interest. She plans to make the minimum payment until the debt is finally paid off.

She quit 9-5 to run Clo-Bare full-time

In October 2023, Daniels left her job as a communications specialist to work full-time with Clo Bare Money Coach.

In addition to posting daily content about saving and investing on Instagram and Tik-Tok (where she now has over 120,000 followers each), Daniels offered 1-on-1 financial coaching. She earned about $5,000 a month in the six months prior to quitting her 9-5 job.

But after Daniels dedicated all her time to her growing business, the profits really started rolling in.

In December, Daniels debuted her Lazy Investor’s Course, with 91 people signing up to access it for $379 each – a launch of nearly $35,000. Just over two years later, the self-paced Lazy Investor’s Course is on sale for $997.

What started as part-time blogging about her personal experiences with saving and budgeting money in 2018 has transformed into a full-time six-figure career running an education platform built around her personal brand.

“I knew I would regret it if I didn’t try,” she says.

Daniels is always quick to point out that she is not a certified financial planner, or licensed to provide specific investment advice. She offers educational resources and shares both the victories and failures she has experienced along her journey.

Several aspects of that journey really resonate with people, especially other women in their late 20s and 30s. Whether she’s struggling to decide whether to pay off her student loans or invest, or escape a financially abusive relationship, her videos are full of comments like “Oh man, I can relate” and “I sure have been, and much more.’

Rather than downplaying her mistakes, Daniels has made a small fortune by embracing them and using them as examples to teach others how to be smarter with their money. Her “nobody’s perfect” approach works, and it’s helping thousands of people learn about investing.

“Over and over again, my students say they chose me because they saw themselves in me,” she says. “And the fact that I tell people that they can be rewarded if they’re lazy about investing – I think that really resonates too.”